A Cook dinner County tax invoice is a doc that outlines the property taxes owed to Cook dinner County, Illinois. This invoice is usually mailed to property house owners in late June or early July and is due in two installments: the primary installment is due on July thirty first, and the second installment is due on September thirtieth. Property taxes are used to fund native authorities providers, comparable to colleges, libraries, and parks.

Cook dinner County tax payments may be paid on-line, by mail, or in particular person on the Cook dinner County Treasurer’s Workplace. If in case you have any questions on your tax invoice, you possibly can contact the Treasurer’s Workplace at (312) 443-5100.

You will need to pay your Cook dinner County tax invoice on time to keep away from penalties and curiosity prices. If you’re unable to pay your invoice in full, you could possibly apply for a fee plan.

Cook dinner County tax invoice

A Cook dinner County tax invoice is a vital doc that outlines the property taxes owed to Cook dinner County, Illinois. This invoice is usually mailed to property house owners in late June or early July and is due in two installments: the primary installment is due on July thirty first, and the second installment is due on September thirtieth. Property taxes are used to fund native authorities providers, comparable to colleges, libraries, and parks.

- Due dates: July thirty first and September thirtieth

- Cost choices: On-line, by mail, or in particular person

- Penalties and curiosity: Could also be charged for late funds

- Cost plans: Accessible for many who can’t pay in full

- Property taxes: Used to fund native authorities providers

- Cook dinner County Treasurer’s Workplace: (312) 443-5100

- On-line funds: Accessible at cookcountytreasurer.com

- In-person funds: Could be made on the Cook dinner County Treasurer’s Workplace

You will need to pay your Cook dinner County tax invoice on time to keep away from penalties and curiosity prices. If in case you have any questions on your tax invoice, you possibly can contact the Treasurer’s Workplace at (312) 443-5100.

Due dates

The due dates for Cook dinner County tax payments are July thirty first and September thirtieth. These due dates are necessary to recollect, as penalties and curiosity prices could also be utilized to late funds. There are a variety of how to pay your Cook dinner County tax invoice, together with on-line, by mail, or in particular person. You will need to select the fee methodology that’s most handy for you and to be sure that your fee is postmarked or acquired by the due date.

-

Aspect 1: Penalties and curiosity prices

Penalties and curiosity prices could also be utilized to late funds of Cook dinner County tax payments. The penalty for late fee is 1.5% per thirty days, and the rate of interest is 1% per thirty days. These prices can add up shortly, so you will need to pay your tax invoice on time.

-

Aspect 2: Cost strategies

There are a variety of how to pay your Cook dinner County tax invoice, together with on-line, by mail, or in particular person. Essentially the most handy methodology for many individuals is to pay on-line. You can even pay by mail by sending a examine or cash order to the Cook dinner County Treasurer’s Workplace. In case you favor to pay in particular person, you are able to do so on the Treasurer’s Workplace or at any of the county’s satellite tv for pc workplaces.

-

Aspect 3: Cost deadlines

The due dates for Cook dinner County tax payments are July thirty first and September thirtieth. You will need to be sure that your fee is postmarked or acquired by the due date to keep away from penalties and curiosity prices.

-

Aspect 4: Cost plans

If you’re unable to pay your Cook dinner County tax invoice in full by the due date, you could possibly apply for a fee plan. Cost plans mean you can unfold out your funds over a time period. To use for a fee plan, you have to to contact the Cook dinner County Treasurer’s Workplace.

By understanding the due dates, fee strategies, and penalties related to Cook dinner County tax payments, you possibly can be sure that you pay your invoice on time and keep away from pointless prices.

Cost choices

Cook dinner County tax payments may be paid on-line, by mail, or in particular person. These fee choices present taxpayers with flexibility and comfort in relation to fulfilling their tax obligations. Paying on-line is a fast and simple method to pay your tax invoice. The Cook dinner County Treasurer’s Workplace web site accepts bank cards, debit playing cards, and digital checks. You can even pay your tax invoice by mail by sending a examine or cash order to the Treasurer’s Workplace. In case you favor to pay in particular person, you are able to do so on the Treasurer’s Workplace or at any of the county’s satellite tv for pc workplaces.

You will need to select the fee methodology that’s most handy for you and to be sure that your fee is postmarked or acquired by the due date. Late funds could also be topic to penalties and curiosity prices.

The provision of a number of fee choices is a vital side of Cook dinner County tax payments. It permits taxpayers to decide on the strategy that most accurately fits their wants and circumstances. This flexibility helps to make sure that taxpayers pays their payments on time and keep away from pointless prices.

Penalties and curiosity

Late funds on Cook dinner County tax payments might end in penalties and curiosity prices, emphasizing the importance of well timed funds to keep away from further monetary burdens.

-

Aspect 1: Penalties for late funds

A penalty of 1.5% per thirty days is imposed on late funds, accumulating over time and rising the entire quantity owed. Understanding this penalty construction encourages immediate fee to attenuate further prices.

-

Aspect 2: Curiosity prices for late funds

Along with penalties, curiosity prices of 1% per thirty days are utilized to late funds, additional rising the monetary burden. These prices function an incentive for well timed funds, selling accountable monetary administration.

-

Aspect 3: Affect on monetary planning

Penalties and curiosity prices can considerably affect monetary planning, as they improve the general value of property possession. Contemplating these potential prices prematurely permits for higher budgeting and monetary preparedness.

-

Aspect 4: Authorized implications of late funds

Persistent late funds might result in authorized motion, together with the imposition of liens on properties and potential foreclosures proceedings. Understanding the authorized penalties of late funds encourages well timed motion to keep away from extreme outcomes.

In conclusion, well timed fee of Cook dinner County tax payments is essential to keep away from penalties, curiosity prices, and potential authorized problems. These monetary penalties underscore the significance of accountable monetary administration and adherence to established due dates.

Cost plans

Cook dinner County tax payments could be a vital monetary obligation for property house owners, and there could also be circumstances the place people are unable to pay the total quantity due by the established deadlines. To handle this problem, Cook dinner County affords fee plans that present flexibility and assist to those that want it.

-

Aspect 1: Eligibility and utility course of

Cost plans can be found to property house owners who’re experiencing monetary hardship and are unable to pay their Cook dinner County tax invoice in full by the due date. To use for a fee plan, property house owners should contact the Cook dinner County Treasurer’s Workplace and supply documentation to assist their monetary state of affairs.

-

Aspect 2: Phrases and situations of fee plans

Cost plans usually contain dividing the excellent tax invoice into smaller, extra manageable installments which are unfold out over a time period. The phrases and situations of the fee plan, together with the variety of installments and the fee due dates, are decided primarily based on the person circumstances of the property proprietor.

-

Aspect 3: Advantages of fee plans

Cost plans supply a number of advantages to property house owners who’re struggling to pay their Cook dinner County tax invoice. They supply flexibility and peace of thoughts by permitting property house owners to keep away from penalties and curiosity prices that will accrue on late funds. Cost plans additionally assist property house owners keep their property and keep away from the danger of foreclosures.

-

Aspect 4: Duties of property house owners

Property house owners who enter right into a fee plan are chargeable for making their funds on time and in accordance with the phrases of the settlement. Failure to adjust to the fee plan might consequence within the termination of the plan and the imposition of penalties and curiosity prices.

To additional assist property house owners experiencing monetary hardship, Cook dinner County affords a wide range of monetary help packages, together with the Cook dinner County Home-owner Help Fund and the Cook dinner County Property Tax Deferral Program. These packages present further sources and assist to assist property house owners keep of their properties and keep away from tax-related points.

By understanding the supply of fee plans and different monetary help packages, property house owners can proactively deal with challenges in paying their Cook dinner County tax invoice and keep their monetary stability.

Property taxes

Property taxes are a main income for native governments, together with Cook dinner County. The income generated from property taxes is important for funding a variety of significant public providers that profit all residents of the county.

-

Aspect 1: Training

Property taxes play an important position in funding public colleges, group schools, and universities. These establishments present academic alternatives for residents of all ages, serving to to develop a talented and educated workforce.

-

Aspect 2: Public security

Property taxes assist fund police and hearth departments, that are chargeable for defending the protection of residents and property. These providers guarantee a protected and safe surroundings for people and households.

-

Aspect 3: Infrastructure

Property taxes contribute to the upkeep and enchancment of native infrastructure, together with roads, bridges, parks, and libraries. These investments improve the standard of life for residents and assist financial progress.

-

Aspect 4: Social providers

Property taxes additionally assist social providers comparable to healthcare, housing help, and packages for seniors and people with disabilities. These providers present a security internet for susceptible populations and contribute to the general well-being of the group.

By understanding the connection between property taxes and the important native authorities providers they fund, Cook dinner County residents can recognize the significance of paying their tax payments on time. These funds be sure that the county has the sources vital to take care of a top quality of life for all residents.

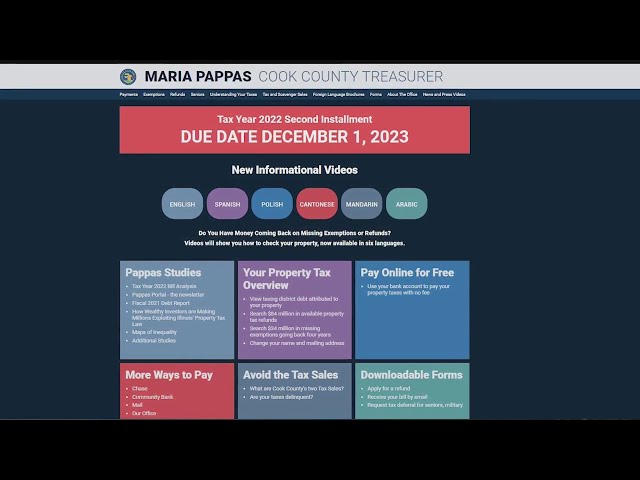

Cook dinner County Treasurer’s Workplace

The Cook dinner County Treasurer’s Workplace performs an important position within the processing and administration of property taxes, making it a vital part of the “cook dinner county tax invoice.” The workplace is chargeable for:

- Mailing tax payments to property house owners

- Accumulating property tax funds

- Distributing property tax income to native taxing our bodies

The telephone quantity (312) 443-5100 is the primary contact for the Cook dinner County Treasurer’s Workplace. Property house owners can name this quantity to inquire about their tax invoice, make funds over the telephone, or request help with different tax-related issues.

Understanding the connection between the Cook dinner County Treasurer’s Workplace and the “cook dinner county tax invoice” is necessary for a number of causes:

- It ensures that property house owners know the place to ship their tax funds and contact the workplace with questions.

- It helps property house owners perceive the method of property tax assortment and distribution.

- It offers a useful resource for property house owners who want help with managing their property taxes.

By working with the Cook dinner County Treasurer’s Workplace, property house owners can be sure that their tax payments are paid on time and that their property tax funds are getting used to assist important native providers.

On-line funds

The provision of on-line funds at cookcountytreasurer.com is a big side of the “cook dinner county tax invoice” for a number of causes. Firstly, it offers property house owners with a handy and environment friendly method to pay their taxes. By using the web portal, property house owners can keep away from the necessity to mail or bodily ship their funds, saving effort and time.

Secondly, on-line funds supply elevated flexibility and accessibility. Property house owners could make funds at any time of day or evening, no matter their location. This flexibility is especially helpful for people with busy schedules or for many who stay in distant areas.

Furthermore, on-line funds via cookcountytreasurer.com make sure the safe and well timed processing of tax funds. The portal makes use of industry-standard safety measures to guard delicate monetary info, giving property house owners peace of thoughts when making on-line transactions.

In abstract, the mixing of on-line funds at cookcountytreasurer.com with the “cook dinner county tax invoice” enhances the general expertise for property house owners. It offers a handy, versatile, and safe methodology of fulfilling tax obligations, finally contributing to the environment friendly functioning of Cook dinner County’s property tax system.

In-person funds

The provision of in-person funds on the Cook dinner County Treasurer’s Workplace is a vital side of the “cook dinner county tax invoice” system, providing property house owners an alternate fee methodology to fulfill their tax obligations. This feature is especially advantageous for people preferring face-to-face interactions, require rapid help, or encounter challenges with on-line or mail-based funds.

By visiting the Cook dinner County Treasurer’s Workplace, property house owners could make funds on to licensed personnel, obtain rapid affirmation of their transactions, and search steering from educated workers relating to any tax-related inquiries. This personalised method offers a way of assurance and permits for real-time decision of payment-related points. Moreover, in-person funds get rid of considerations about postal delays or potential mail loss, guaranteeing well timed processing of tax funds and avoiding the danger of late penalties.

Understanding the importance of in-person funds as a part of the “cook dinner county tax invoice” empowers property house owners with the information and adaptability to decide on the fee methodology that greatest aligns with their preferences and circumstances. It contributes to a complete and accessible tax fee system that accommodates the varied wants of Cook dinner County residents.

FAQs

This part offers solutions to continuously requested questions relating to Cook dinner County tax payments, aiming to make clear frequent considerations and misconceptions.

Query 1: When are Cook dinner County tax payments due?

Cook dinner County tax payments are usually mailed in late June or early July and are due in two installments: the primary installment is due on July thirty first, and the second installment is due on September thirtieth.

Query 2: How can I pay my Cook dinner County tax invoice?

There are a number of methods to pay your Cook dinner County tax invoice, together with on-line at cookcountytreasurer.com, by mail, or in particular person on the Cook dinner County Treasurer’s Workplace.

Query 3: What occurs if I miss the Cook dinner County tax invoice due date?

Late funds could also be topic to penalties and curiosity prices. The penalty for late fee is 1.5% per thirty days, and the rate of interest is 1% per thirty days.

Query 4: Can I arrange a fee plan for my Cook dinner County tax invoice?

Sure, fee plans can be found for many who are unable to pay their Cook dinner County tax invoice in full by the due date. To use for a fee plan, you have to to contact the Cook dinner County Treasurer’s Workplace.

Query 5: The place can I get assist with my Cook dinner County tax invoice?

If in case you have any questions or want help together with your Cook dinner County tax invoice, you possibly can contact the Cook dinner County Treasurer’s Workplace at (312) 443-5100.

Query 6: What’s the Cook dinner County Treasurer’s Workplace telephone quantity?

The Cook dinner County Treasurer’s Workplace telephone quantity is (312) 443-5100.

These FAQs present a concise overview of key facets associated to Cook dinner County tax payments. By understanding these important particulars, property house owners can guarantee well timed funds and keep away from potential penalties or problems.

Notice: For additional inquiries or personalised steering, it is suggested to contact the Cook dinner County Treasurer’s Workplace instantly.

Suggestions for Managing Cook dinner County Tax Payments

Understanding and managing your Cook dinner County tax invoice is important to make sure well timed funds, keep away from penalties, and keep good monetary standing. Listed below are a couple of ideas that can assist you navigate the method:

Tip 1: Assessment Your Invoice FastidiouslyTotally overview your tax invoice to make sure accuracy. Verify for errors in property info, assessed worth, and tax calculations. In case you discover any discrepancies, contact the Cook dinner County Treasurer’s Workplace instantly.

Tip 2: Pay on TimeMeet the tax invoice due dates to keep away from penalties and curiosity prices. The primary installment is due on July thirty first, and the second installment is due on September thirtieth.

Tip 3: Discover Cost ChoicesSelect the fee methodology that most accurately fits your wants. You’ll be able to pay on-line, by mail, or in particular person on the Cook dinner County Treasurer’s Workplace. Take into account establishing computerized funds to keep away from missed due dates.

Tip 4: Apply for Cost PlanIn case you can’t pay your tax invoice in full, contact the Treasurer’s Workplace to inquire about fee plan choices. These plans mean you can unfold out your funds over a time period.

Tip 5: Search HelpIn case you encounter any difficulties or have questions on your tax invoice, don’t hesitate to contact the Cook dinner County Treasurer’s Workplace. They will present steering and assist that can assist you resolve your considerations.

By following the following pointers, you possibly can successfully handle your Cook dinner County tax payments, guaranteeing well timed funds, avoiding pointless prices, and sustaining a optimistic monetary standing.

Conclusion

Cook dinner County tax payments play a essential position in funding important native authorities providers that profit all residents. Understanding the parts, fee choices, and implications of those payments is essential for accountable property possession.

By reviewing your tax invoice completely, assembly fee deadlines, exploring versatile fee preparations, and searching for help when wanted, you possibly can successfully handle your Cook dinner County tax obligations. This not solely ensures well timed funds and avoids penalties but in addition contributes to the general well-being of the group. Keep in mind, well timed fee of property taxes helps important providers comparable to schooling, public security, infrastructure, and social providers.

Youtube Video: