A Prepare dinner County property tax search is a web based instrument that enables customers to seek for property tax data for any property in Prepare dinner County, Illinois. The search could be carried out by tackle, property index quantity, or proprietor’s identify. The outcomes of the search will embrace the property’s authorized description, assessed worth, market worth, and present tax invoice.

Property tax searches are vital for quite a lot of causes. First, they might help property homeowners to make sure that they’re paying the correct quantity of taxes. Second, they might help potential consumers and sellers to analysis properties earlier than making a purchase order or sale. Third, they might help researchers and journalists to trace property values and tendencies.

The Prepare dinner County property tax search is a beneficial instrument for anybody who must analysis property tax data in Prepare dinner County, Illinois.

Prepare dinner County Property Tax Search

A Prepare dinner County property tax search is a beneficial instrument for anybody who must analysis property tax data in Prepare dinner County, Illinois. Listed below are 10 key elements of a Prepare dinner County property tax search:

- Property Handle: Search by the property’s road tackle or map quantity.

- Proprietor’s Identify: Search by the identify of the property proprietor.

- Property Index Quantity: Search by the property’s distinctive identification quantity.

- Authorized Description: View the authorized description of the property.

- Assessed Worth: Discover the property’s assessed worth, which is used to calculate property taxes.

- Market Worth: View the property’s estimated market worth.

- Present Tax Invoice: View the property’s present tax invoice, together with the quantity of taxes due and the due date.

- Cost Historical past: View the property’s fee historical past, together with the dates and quantities of earlier funds.

- Exemptions: View any exemptions that the property could also be eligible for, such because the house owner’s exemption.

- Tax Gross sales: Seek for properties which were offered for unpaid taxes.

These key elements present a complete overview of the knowledge that’s accessible by a Prepare dinner County property tax search. This data can be utilized for quite a lot of functions, akin to:

- Guaranteeing that you’re paying the correct quantity of property taxes.

- Researching properties earlier than shopping for or promoting.

- Monitoring property values and tendencies.

- Discovering out if a property is eligible for any exemptions.

- Researching properties which were offered for unpaid taxes.

Property Handle

The property tackle is a vital piece of knowledge for a Prepare dinner County property tax search. It permits customers to shortly and simply discover the property they’re considering, no matter whether or not they know the property’s index quantity or proprietor’s identify.

-

Aspect 1: Comfort and Accessibility

Looking out by property tackle is essentially the most handy and accessible method to carry out a Prepare dinner County property tax search. Customers can merely enter the property’s road tackle or map quantity into the search bar and click on “search.” That is particularly useful for customers who have no idea the property’s index quantity or proprietor’s identify.

-

Aspect 2: Accuracy and Precision

Looking out by property tackle can also be a really correct and exact method to discover the proper property. It is because the property tackle is a novel identifier for every property in Prepare dinner County. This helps to make sure that customers will discover the proper property, even when there are a number of properties with related names or homeowners.

-

Aspect 3: Complete Outcomes

Looking out by property tackle returns essentially the most complete outcomes. It is because the search outcomes will embrace all the data that’s accessible for the property, together with the property’s authorized description, assessed worth, market worth, present tax invoice, fee historical past, exemptions, and tax gross sales historical past.

-

Aspect 4: Time-Saving

Looking out by property tackle can save customers plenty of time. It is because customers should not have to spend time looking for the property’s index quantity or proprietor’s identify. This may be particularly useful for customers who’re researching a number of properties.

Total, looking out by property tackle is essentially the most handy, accessible, correct, exact, complete, and time-saving method to carry out a Prepare dinner County property tax search.

Proprietor’s Identify

Looking for property tax data by proprietor’s identify is a beneficial characteristic of the Prepare dinner County property tax search instrument. It permits customers to shortly and simply discover properties owned by a specific particular person or entity, whatever the property’s tackle or index quantity.

This characteristic is especially helpful for a number of causes. First, it might probably assist customers to trace down properties which can be owned by a specific particular person or entity, even when they have no idea the property’s tackle or index quantity. This may be useful for quite a lot of functions, akin to:

- Investigating potential conflicts of curiosity.

- Monitoring the possession historical past of a specific property.

- Discovering out who owns a vacant or deserted property.

Second, looking out by proprietor’s identify might help customers to determine properties which can be owned by a number of people or entities. This data could be useful for quite a lot of functions, akin to:

- Figuring out the possession construction of a specific property.

- Discovering out who’s answerable for paying the property taxes.

- Figuring out potential heirs to a property.

Total, trying to find property tax data by proprietor’s identify is a beneficial instrument for anybody who must analysis property possession data in Prepare dinner County, Illinois.

Property Index Quantity

The Property Index Quantity (PIN) is a novel identification quantity assigned to every property in Prepare dinner County, Illinois. It’s a 14-digit quantity that’s used to determine the property for tax functions. The PIN can also be used to trace the property’s possession and evaluation historical past.

-

Aspect 1: Significance of the PIN

The PIN is a crucial piece of knowledge for a Prepare dinner County property tax search. It permits customers to shortly and simply discover the property they’re considering, even when they have no idea the property’s tackle or proprietor’s identify.

-

Aspect 2: The place to Discover the PIN

The PIN could be discovered on the property’s tax invoice or on the Prepare dinner County Assessor’s web site. It will also be obtained by calling the Prepare dinner County Assessor’s workplace.

-

Aspect 3: Utilizing the PIN to Seek for Property Tax Data

After getting the PIN, you need to use it to seek for property tax data on the Prepare dinner County Assessor’s web site. The search outcomes will embrace all the data that’s accessible for the property, together with the property’s authorized description, assessed worth, market worth, present tax invoice, fee historical past, exemptions, and tax gross sales historical past.

-

Aspect 4: Advantages of Utilizing the PIN

Utilizing the PIN to seek for property tax data has a number of advantages. First, it’s a fast and simple method to discover the knowledge you want. Second, it’s a very correct method to discover the proper property, even when there are a number of properties with related names or homeowners. Third, it’s a complete method to discover all the data that’s accessible for the property.

Total, the PIN is a beneficial instrument for anybody who must analysis property tax data in Prepare dinner County, Illinois.

Authorized Description

The authorized description is an in depth description of the property’s boundaries and site. It will be significant as a result of it offers a transparent and unambiguous method to determine the property and distinguish it from different properties. The authorized description can also be used to calculate the property’s assessed worth and tax invoice.

The authorized description is a part of the Prepare dinner County property tax search as a result of it’s essential to determine the property and decide its assessed worth and tax invoice. With out the authorized description, it might be troublesome to make sure that the property is being taxed accurately.

Right here is an instance of a authorized description:

LOT 12 IN THE SUBDIVISION OF THE WEST 1/2 OF THE SOUTHEAST 1/4 OF SECTION 21, TOWNSHIP 42 NORTH, RANGE 13, EAST OF THE THIRD PRINCIPAL MERIDIAN, IN COOK COUNTY, ILLINOIS.

This authorized description identifies the property as Lot 12 in a subdivision of a bigger parcel of land. The bigger parcel of land is positioned within the West 1/2 of the Southeast 1/4 of Part 21, Township 42 North, Vary 13, East of the Third Principal Meridian, in Prepare dinner County, Illinois.

Authorized descriptions could be complicated and obscure. Nevertheless, they’re an vital a part of the property tax evaluation and assortment course of. By understanding the authorized description of a property, taxpayers can be sure that they’re paying the correct quantity of taxes.

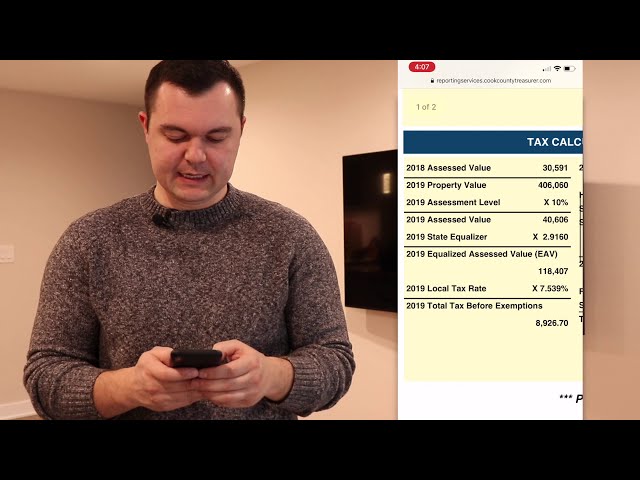

Assessed Worth

Within the context of a Prepare dinner County property tax search, the assessed worth of a property is a vital piece of knowledge. It serves as the muse for calculating the property’s tax invoice and performs a major position in figuring out the quantity of taxes owed by the property proprietor.

-

Aspect 1: Understanding Assessed Worth

Assessed worth represents the estimated market worth of a property as decided by the county assessor. It’s usually decrease than the property’s precise market worth, contemplating elements such because the property’s age, situation, and site. Understanding the assessed worth helps property homeowners assess the accuracy of their tax invoice and determine potential discrepancies.

-

Aspect 2: Position in Property Tax Calculation

The assessed worth kinds the idea for calculating property taxes. Prepare dinner County determines the tax fee annually, which is then utilized to the assessed worth to find out the quantity of taxes due. Property homeowners can use this data to estimate their annual property tax legal responsibility.

-

Aspect 3: Implications for Property Homeowners

The assessed worth has vital implications for property homeowners. A better assessed worth may end up in larger property taxes, probably impacting the proprietor’s monetary state of affairs. Conversely, a decrease assessed worth can result in decrease tax payments, offering monetary aid to the proprietor.

-

Aspect 4: Contesting Assessed Worth

Property homeowners have the fitting to contest the assessed worth of their property in the event that they imagine it’s inaccurate. By submitting an enchantment with the county assessor, property homeowners can present proof to help a decrease assessed worth, probably lowering their property tax burden.

The assessed worth of a property is a crucial part of the Prepare dinner County property tax search. By understanding the assessed worth, property homeowners could make knowledgeable choices relating to their property taxes, guaranteeing equity and accuracy within the property tax evaluation and assortment course of.

Market Worth

Inside the context of a Prepare dinner County property tax search, understanding the market worth of a property holds nice significance. It performs a vital position in figuring out the property’s assessed worth, which kinds the idea for calculating property taxes.

Market worth represents the estimated worth a property would fetch in a aggressive actual property market. It considers elements such because the property’s location, measurement, situation, and up to date comparable gross sales within the space. By offering an estimate of the property’s price, the market worth assists in guaranteeing honest and correct property tax assessments.

The Prepare dinner County property tax search incorporates market worth as a key part. It permits property homeowners to entry this data, permitting them to check it with the assessed worth and determine any potential discrepancies. This empowers them to make knowledgeable choices relating to their property taxes and contest the assessed worth if essential.

As an illustration, if a property proprietor believes that the assessed worth is larger than the precise market worth, they will file an enchantment with proof supporting their declare. By presenting comparable gross sales knowledge or latest value determinations, they will exhibit the property’s true price and probably safe a decrease assessed worth, resulting in decreased property taxes.

Understanding the connection between market worth and Prepare dinner County property tax search empowers property homeowners to actively take part within the property tax evaluation course of. It offers them with a beneficial instrument to make sure correct tax assessments and safeguard their monetary pursuits.

Present Tax Invoice

The “Present Tax Invoice” part holds vital significance throughout the context of a Prepare dinner County property tax search. It offers property homeowners with essential data relating to their property’s tax legal responsibility and the related due date for fee. Understanding this part empowers property homeowners to satisfy their tax obligations precisely and on time.

-

Aspect 1: Entry to Cost Data

The “Present Tax Invoice” offers property homeowners with complete particulars about their present tax invoice. This contains the full quantity of taxes due, the breakdown of various tax elements (e.g., county tax, college tax, and so forth.), and any relevant late charges or penalties. This data is essential for budgeting and guaranteeing well timed funds, avoiding potential penalties akin to tax liens or foreclosures.

-

Aspect 2: Cost Due Dates

The “Present Tax Invoice” clearly shows the due date for property tax funds. Property homeowners should adhere to those deadlines to keep away from penalties and preserve fee historical past. The Prepare dinner County property tax search permits property homeowners to simply entry this data, enabling them to plan their funds accordingly and stop any potential disruptions of their monetary obligations.

-

Aspect 3: Dispute Decision

If property homeowners have any considerations or disputes relating to their tax invoice, the “Present Tax Invoice” offers beneficial data. It permits them to determine the suitable contact individual or division throughout the Prepare dinner County authorities for resolving these points. This facilitates well timed communication and helps property homeowners navigate the method of addressing any discrepancies or errors of their tax evaluation.

In abstract, the “Present Tax Invoice” part of the Prepare dinner County property tax search is an important instrument for property homeowners. It offers them with the required data to grasp their tax legal responsibility, meet fee deadlines, and resolve any potential points. By leveraging this part, property homeowners can be sure that they fulfill their tax obligations precisely and preserve a transparent understanding of their property’s tax standing.

Cost Historical past

The “Cost Historical past” part throughout the Prepare dinner County property tax search instrument offers essential insights right into a property’s tax fee file. It serves as a beneficial useful resource for property homeowners, potential consumers, and researchers, providing a complete view of previous funds and serving to to evaluate the property’s monetary historical past.

-

Aspect 1: Verifying Cost Information

The “Cost Historical past” permits property homeowners to confirm their fee information, guaranteeing that every one funds have been made on time and within the right quantities. This data is especially helpful for properties with complicated possession buildings or those who have just lately modified palms, because it offers a transparent and simply accessible file of previous funds.

-

Aspect 2: Figuring out Potential Points

By reviewing the “Cost Historical past,” potential consumers can determine any potential points associated to the property’s tax standing. As an illustration, a historical past of late funds or excellent balances might point out monetary misery or different underlying issues that might have an effect on the property’s worth or desirability.

-

Aspect 3: Researching Property Traits

Researchers and analysts can make the most of the “Cost Historical past” to trace property tax fee tendencies over time. This data can present insights into the monetary well being of a specific neighborhood or area, in addition to determine patterns in property tax assortment and enforcement.

In conclusion, the “Cost Historical past” part of the Prepare dinner County property tax search instrument is a useful useful resource for property homeowners, potential consumers, and researchers alike. It offers an in depth and simply accessible file of previous funds, serving to to make sure accuracy, determine potential points, and achieve insights into property tax tendencies.

Exemptions

The “Exemptions” part of the Prepare dinner County property tax search instrument performs a vital position in figuring out and understanding the assorted exemptions that will apply to a property, probably lowering the general tax burden for eligible property homeowners.

Exemptions are deductions or reductions utilized to the assessed worth of a property, leading to decrease property taxes. The Prepare dinner County property tax search permits property homeowners to simply decide in the event that they qualify for any exemptions, such because the house owner’s exemption, which offers a major discount in taxes for owner-occupied properties.

Understanding the supply and eligibility standards for exemptions is important for property homeowners to optimize their tax financial savings. The Prepare dinner County property tax search instrument offers a complete listing of obtainable exemptions, together with detailed data on the necessities and utility course of. This empowers property homeowners to make knowledgeable choices and benefit from any relevant exemptions, guaranteeing honest and equitable property tax assessments.

As an illustration, senior residents and disabled people might qualify for added exemptions, additional lowering their property tax legal responsibility. By leveraging the “Exemptions” part of the Prepare dinner County property tax search, these people can determine and apply for the suitable exemptions, offering much-needed monetary aid.

In conclusion, the “Exemptions” part of the Prepare dinner County property tax search is an indispensable instrument for property homeowners to discover and perceive the assorted exemptions that will apply to their property. It empowers them to cut back their tax burden, optimize their monetary state of affairs, and guarantee correct and honest property tax assessments.

Tax Gross sales

Inside the context of a Prepare dinner County property tax search, the part specializing in “Tax Gross sales” holds vital significance. It permits customers to seek for properties which were offered for unpaid taxes, offering beneficial insights into the property’s monetary historical past and potential funding alternatives.

Unpaid property taxes can result in tax liens and ultimately outcome within the property being offered at a tax sale. By trying to find tax gross sales, potential consumers can determine properties which can be accessible for buy at a reduced worth. This data is especially helpful for buyers in search of undervalued properties or people in search of reasonably priced housing choices.

The Prepare dinner County property tax search instrument offers detailed data on tax gross sales, together with the property’s tackle, authorized description, assessed worth, and the quantity of unpaid taxes. This data empowers customers to make knowledgeable choices about potential property purchases and navigate the tax sale course of successfully.

As an illustration, an investor researching potential funding properties may use the tax gross sales part to determine distressed properties with excessive potential returns. By analyzing the unpaid tax quantities and property values, they will assess the viability of investing in these properties and make strategic choices.

In abstract, the “Tax Gross sales” part of the Prepare dinner County property tax search is an important instrument for buyers, potential homebuyers, and researchers in search of data on properties offered for unpaid taxes. It offers beneficial insights into property possession historical past, monetary misery, and funding alternatives, enabling customers to make knowledgeable choices and navigate the tax sale course of successfully.

Guaranteeing that you’re paying the correct quantity of property taxes.

Within the context of property possession and monetary obligations, guaranteeing that you’re paying the correct quantity of property taxes is of paramount significance. The Prepare dinner County property tax search instrument performs a significant position in facilitating this course of by offering complete data and assets.

-

Aspect 1: Correct Property Evaluation

An important facet of guaranteeing right property tax funds lies in correct property evaluation. The Prepare dinner County property tax search instrument permits property homeowners to entry particulars about their property’s assessed worth, which kinds the idea for tax calculations. By reviewing this data, property homeowners can determine any discrepancies or errors within the evaluation, guaranteeing that their tax legal responsibility is honest and proportionate.

-

Aspect 2: Eligibility for Exemptions and Reductions

Many property homeowners could also be eligible for exemptions or reductions of their property taxes. The Prepare dinner County property tax search instrument offers data on varied exemption applications, such because the house owner’s exemption or senior citizen exemptions. By exploring these choices, property homeowners can probably decrease their tax burden and optimize their monetary state of affairs.

-

Aspect 3: Cost Historical past and Delinquencies

The Prepare dinner County property tax search instrument affords insights right into a property’s fee historical past, together with any excellent balances or delinquencies. This data is crucial for property homeowners to keep away from penalties and potential authorized penalties. By staying knowledgeable about their fee standing, property homeowners can take proactive steps to satisfy their tax obligations and preserve a transparent monetary file.

-

Aspect 4: Analysis and Due Diligence

For potential property consumers or buyers, the Prepare dinner County property tax search instrument serves as a beneficial useful resource for due diligence. By researching the property tax historical past of a possible buy, consumers can achieve insights into the property’s monetary obligations and make knowledgeable choices. This data might help keep away from surprises or surprising monetary burdens sooner or later.

In conclusion, the Prepare dinner County property tax search instrument is an indispensable useful resource for property homeowners, potential consumers, and buyers in search of to make sure that they’re paying the correct quantity of property taxes. By leveraging the knowledge and assets offered by the instrument, property homeowners can fulfill their monetary obligations precisely, optimize their tax legal responsibility, and make knowledgeable choices associated to their property.

Researching properties earlier than shopping for or promoting.

Conducting thorough analysis on properties earlier than making a purchase order or sale choice is a vital step in actual property transactions. The Prepare dinner County property tax search instrument performs a major position on this course of by offering beneficial data that may empower people to make knowledgeable choices.

Understanding property tax implications is important for consumers and sellers alike. The Prepare dinner County property tax search instrument permits customers to entry detailed details about a property’s tax historical past, together with present and previous tax payments, exemptions, and any excellent liens or delinquencies. By reviewing this data, potential consumers can assess the continuing monetary obligations related to the property and issue these prices into their buying choices.

Equally, sellers can make the most of the Prepare dinner County property tax search instrument to make sure that they’re assembly their tax obligations and to supply correct data to potential consumers. A transparent and up-to-date tax historical past can improve the property’s marketability and instill confidence in consumers.

Researching property taxes additionally helps people keep away from potential authorized problems and monetary pitfalls. Unpaid property taxes can result in penalties, liens, and even foreclosures. Through the use of the Prepare dinner County property tax search instrument, people can keep knowledgeable about their tax standing and take proactive steps to keep away from any adversarial penalties.

In conclusion, researching properties earlier than shopping for or promoting is a crucial part of actual property transactions. The Prepare dinner County property tax search instrument is an important useful resource that empowers people to make knowledgeable choices by offering complete details about a property’s tax historical past and obligations.

Monitoring property values and tendencies

Monitoring property values and tendencies is a vital facet of actual property investing, market evaluation, and knowledgeable decision-making for householders and potential consumers. The Prepare dinner County property tax search instrument performs a major position on this course of by offering beneficial knowledge and insights.

-

Aspect 1: Monitoring Market Circumstances

The Prepare dinner County property tax search instrument permits customers to trace property values over time, offering insights into market tendencies and fluctuations. By analyzing historic tax knowledge, buyers and householders can determine areas with rising or declining property values, serving to them make knowledgeable funding choices and assess the potential return on their investments.

-

Aspect 2: Comparative Evaluation

The Prepare dinner County property tax search instrument permits customers to check property values inside neighborhoods, college districts, and completely different geographical areas. This comparative evaluation helps buyers and householders perceive the relative worth of properties, determine undervalued or overpriced properties, and make knowledgeable choices about potential purchases or gross sales.

-

Aspect 3: Assessing Lengthy-Time period Traits

The Prepare dinner County property tax search instrument offers entry to historic tax knowledge, permitting customers to trace property values over prolonged durations. This long-term evaluation helps buyers and householders determine rising tendencies, akin to gentrification or financial decline, which might affect property values and funding methods.

-

Aspect 4: Informing Funding Selections

Actual property buyers depend on property worth tendencies to make knowledgeable funding choices. The Prepare dinner County property tax search instrument offers beneficial knowledge on property values, tax charges, and historic tendencies, empowering buyers to conduct thorough due diligence and determine potential funding alternatives with larger returns.

In conclusion, the Prepare dinner County property tax search instrument is a useful useful resource for monitoring property values and tendencies. By offering complete knowledge and insights, this instrument permits householders, potential consumers, and buyers to make knowledgeable choices, assess market situations, and determine funding alternatives.

Discovering out if a property is eligible for any exemptions.

Within the realm of property tax assessments and funds, understanding the eligibility of a property for exemptions holds vital significance. The Prepare dinner County property tax search instrument offers a complete platform for property homeowners to determine whether or not their property qualifies for any exemptions that may probably scale back their tax legal responsibility.

-

Aspect 1: House owner’s Exemption

Some of the frequent exemptions is the house owner’s exemption, which grants a discount within the assessed worth of owner-occupied residential properties. By looking out by the Prepare dinner County property tax search instrument, householders can decide in the event that they meet the eligibility standards and apply for this exemption, resulting in potential tax financial savings.

-

Aspect 2: Senior Citizen Exemptions

Prepare dinner County affords exemptions tailor-made to senior residents who meet particular age and earnings necessities. These exemptions can present substantial property tax aid, easing the monetary burden on aged householders. The property tax search instrument permits seniors to discover their eligibility and apply for these exemptions.

-

Aspect 3: Incapacity Exemptions

Property homeowners with disabilities may qualify for exemptions that scale back their property tax legal responsibility. The Prepare dinner County property tax search instrument offers data on the eligibility standards and utility course of for incapacity exemptions, serving to people with disabilities entry these advantages.

-

Aspect 4: Veterans’ Exemptions

Prepare dinner County acknowledges the service of veterans by property tax exemptions. Veterans who meet sure standards, akin to size of service and incapacity standing, can apply for exemptions that may considerably scale back their property tax burden. The property tax search instrument assists veterans in figuring out their eligibility and making use of for these exemptions.

By leveraging the Prepare dinner County property tax search instrument, property homeowners can proactively determine and apply for exemptions that may decrease their tax legal responsibility. These exemptions not solely present monetary aid but additionally exhibit the county’s dedication to supporting householders, senior residents, people with disabilities, and veterans.

Researching properties which were offered for unpaid taxes.

Inside the complete framework of the Prepare dinner County property tax search, researching properties which were offered for unpaid taxes holds immense significance. This facet of the search instrument empowers people to realize beneficial insights into the property’s monetary historical past and potential funding alternatives.

Understanding the method of tax gross sales is essential. When property taxes stay unpaid, the county might place a tax lien on the property. If the taxes and related charges usually are not settled inside a specified interval, the property could also be offered at a tax sale. The Prepare dinner County property tax search instrument offers entry to data on properties which have gone by this course of.

For buyers, researching tax gross sales can result in the identification of undervalued properties that may be acquired at a reduced worth. By analyzing the unpaid tax quantities, property values, and different related particulars, buyers could make knowledgeable choices about potential investments. This data will also be beneficial for people in search of reasonably priced housing choices.

Moreover, researching properties which were offered for unpaid taxes can present insights right into a neighborhood’s monetary well being and stability. Areas with a excessive variety of tax gross sales might point out financial misery, whereas a low variety of tax gross sales might recommend a extra secure actual property market.

In conclusion, researching properties which were offered for unpaid taxes is an integral part of the Prepare dinner County property tax search instrument. It empowers people to make knowledgeable funding choices, achieve insights right into a neighborhood’s monetary well being, and determine potential alternatives for buying undervalued properties.

Ceaselessly Requested Questions on Prepare dinner County Property Tax Search

The Prepare dinner County property tax search is a beneficial instrument for anybody who must analysis property tax data in Prepare dinner County, Illinois. Listed below are some ceaselessly requested questions concerning the search instrument:

Query 1: What data can I discover utilizing the Prepare dinner County property tax search?

Reply: Yow will discover quite a lot of data utilizing the Prepare dinner County property tax search, together with the property’s authorized description, assessed worth, market worth, present tax invoice, fee historical past, exemptions, and tax gross sales historical past.

Query 2: How do I seek for a property utilizing the Prepare dinner County property tax search?

Reply: You may seek for a property utilizing the Prepare dinner County property tax search by tackle, property index quantity, or proprietor’s identify.

Query 3: What’s the distinction between assessed worth and market worth?

Reply: Assessed worth is the worth that the county assessor determines the property to be price for tax functions. Market worth is the estimated worth that the property would promote for on the open market.

Query 4: What are exemptions?

Reply: Exemptions are deductions or reductions that may be utilized to the assessed worth of a property, leading to decrease property taxes. Widespread exemptions embrace the house owner’s exemption and the senior citizen exemption.

Query 5: What’s a tax sale?

Reply: A tax sale is a sale of a property that has been offered for unpaid taxes. Properties which can be offered at tax gross sales are usually offered at a reduced worth.

Query 6: How can I discover out if a property is eligible for an exemption?

Reply: Yow will discover out if a property is eligible for an exemption by contacting the Prepare dinner County Assessor’s workplace.

These are just some of the ceaselessly requested questions concerning the Prepare dinner County property tax search. For extra data, please go to the Prepare dinner County Assessor’s web site.

Abstract: The Prepare dinner County property tax search is a beneficial instrument for anybody who must analysis property tax data in Prepare dinner County, Illinois. The search instrument is simple to make use of and offers a wealth of details about properties in Prepare dinner County.

Transition to the subsequent article part: In case you are considering studying extra about property taxes in Prepare dinner County, please proceed studying the next article.

Ideas for Utilizing the Prepare dinner County Property Tax Search

The Prepare dinner County property tax search is a beneficial instrument for anybody who must analysis property tax data in Prepare dinner County, Illinois. Listed below are 5 suggestions for utilizing the search instrument:

Tip 1: Use the proper search standards.

The Prepare dinner County property tax search permits you to seek for properties by tackle, property index quantity, or proprietor’s identify. Be certain to make use of the proper search standards to make sure that you discover the proper property.Tip 2: Evaluate all the data that’s accessible.

The Prepare dinner County property tax search offers a wealth of details about properties in Prepare dinner County, together with the property’s authorized description, assessed worth, market worth, present tax invoice, fee historical past, exemptions, and tax gross sales historical past. You should definitely evaluate all the data that’s accessible to get an entire image of the property.Tip 3: Contact the Prepare dinner County Assessor’s workplace in case you have any questions.

You probably have any questions concerning the Prepare dinner County property tax search or about property taxes on the whole, please contact the Prepare dinner County Assessor’s workplace. The Assessor’s workplace could be reached by telephone at (312) 443-7550 or by e mail at assessorinfo@cookcountyil.gov.Tip 4: Pay attention to the deadlines for paying your property taxes.

Property taxes in Prepare dinner County are due in two installments: the primary installment is due on March 1st and the second installment is due on August 1st. There’s a 10-day grace interval after every due date, however curiosity shall be charged on any unpaid taxes after the grace interval has expired.Tip 5: Reap the benefits of the exemptions that you’re eligible for.

There are a variety of exemptions that may be utilized to the assessed worth of a property, leading to decrease property taxes. Widespread exemptions embrace the house owner’s exemption and the senior citizen exemption. To seek out out if you’re eligible for an exemption, please contact the Prepare dinner County Assessor’s workplace.

By following the following pointers, you may take advantage of the Prepare dinner County property tax search and guarantee that you’re paying the correct quantity of property taxes.

Abstract: The Prepare dinner County property tax search is a beneficial instrument for anybody who must analysis property tax data in Prepare dinner County, Illinois. By following the information above, you need to use the search instrument to seek out the knowledge you want and guarantee that you’re paying the correct quantity of property taxes.

Conclusion

The Prepare dinner County property tax search is a beneficial instrument for anybody who must analysis property tax data in Prepare dinner County, Illinois. The search instrument is simple to make use of and offers a wealth of details about properties in Prepare dinner County, together with the property’s authorized description, assessed worth, market worth, present tax invoice, fee historical past, exemptions, and tax gross sales historical past.

Through the use of the Prepare dinner County property tax search, you may guarantee that you’re paying the correct quantity of property taxes and that you’re benefiting from all the exemptions that you’re eligible for. You can too use the search instrument to analysis properties that you’re considering shopping for or promoting, or to trace property values and tendencies in your neighborhood.

Youtube Video: