A self-employment tax kind is a doc used to report and pay taxes on revenue earned from self-employment. This kind is utilized by people who’re self-employed, corresponding to freelancers, contractors, and small enterprise homeowners. The self-employment tax kind calculates the quantity of taxes owed on self-employment revenue, together with revenue tax, Social Safety tax, and Medicare tax.

Submitting a self-employment tax kind is necessary as a result of it ensures that self-employed people are paying their fair proportion of taxes. Self-employment taxes assist to fund necessary authorities applications, corresponding to Social Safety and Medicare. Submitting a self-employment tax kind additionally helps to keep away from penalties and curiosity fees which may be imposed on people who fail to file their taxes on time.

If you’re self-employed, you will want to file a self-employment tax kind annually. The deadline for submitting self-employment taxes is April fifteenth. You’ll be able to file your self-employment taxes on-line or by mail.

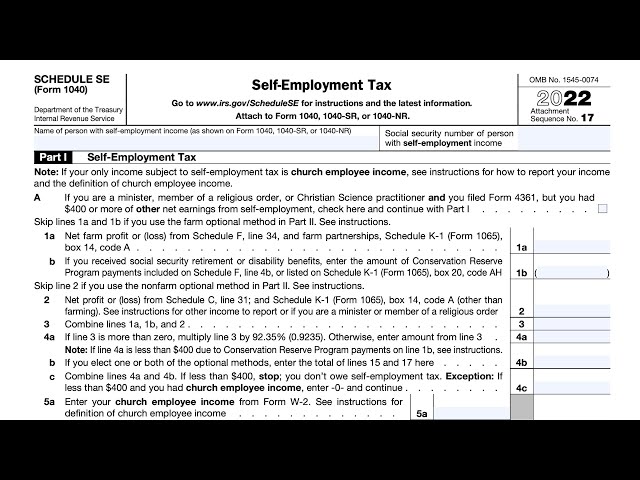

self employment tax kind

A self-employment tax kind is a vital doc for people who earn revenue from self-employment. Understanding its key features is crucial for correct tax reporting and compliance.

- Definition: Type used to calculate and pay taxes on self-employment revenue.

- Significance: Ensures cost of revenue tax, Social Safety tax, and Medicare tax.

- Submitting: Required yearly by April fifteenth, on-line or by mail.

- Penalties: Failure to file can lead to penalties and curiosity fees.

- Self-Employed People: Freelancers, contractors, and small enterprise homeowners.

- Tax Calculation: Calculates taxes based mostly on internet self-employment revenue.

- Schedule SE: Used to report self-employment revenue and taxes on Type 1040.

- Estimated Taxes: Quarterly funds could also be required for estimated self-employment taxes.

These key features spotlight the importance of self-employment tax varieties. They be sure that self-employed people contribute their fair proportion to authorities applications, keep away from penalties, and preserve compliance with tax rules. Correct and well timed submitting of self-employment tax varieties is crucial for monetary safety and peace of thoughts.

Definition

This definition encapsulates the first goal of a self-employment tax kind, which is to function a device for calculating and remitting taxes owed on revenue earned via self-employment. It establishes the shape’s basic function within the tax compliance course of for self-employed people.

- Tax Calculation: The self-employment tax kind calculates taxes based mostly on the web self-employment revenue reported by the taxpayer. This consists of revenue from companies, freelance work, and different self-employed actions.

- Tax Varieties: The shape calculates three sorts of taxes: revenue tax, Social Safety tax, and Medicare tax. Self-employed people are chargeable for paying each the worker and employer parts of those taxes, that are usually mixed right into a single cost.

- Revenue Reporting: The self-employment tax kind requires taxpayers to report their self-employment revenue, bills, and deductions. This info is used to find out the web self-employment revenue topic to taxation.

- Tax Fee: As soon as the taxes have been calculated, the self-employment tax kind offers directions for making the tax cost. This may be finished electronically, by mail, or via a tax skilled.

Understanding the definition and parts of a self-employment tax kind empowers self-employed people to precisely report their revenue and fulfill their tax obligations. It ensures compliance with tax legal guidelines, avoids penalties, and contributes to the funding of important authorities applications.

Significance

The self-employment tax kind performs an important function in guaranteeing that self-employed people fulfill their tax obligations and contribute to important authorities applications. By precisely reporting their self-employment revenue and paying the required taxes, self-employed people contribute to the funding of significant companies corresponding to:

- Social Safety: This program offers retirement, incapacity, and survivor advantages to eligible people and their households. Self-employment taxes fund the Social Safety Belief Fund, which ensures the continued availability of those advantages.

- Medicare: This program offers medical insurance protection for people aged 65 and over, in addition to for youthful people with sure disabilities. Self-employment taxes contribute to the Medicare Belief Fund, which helps the availability of those important healthcare companies.

- Revenue Tax: Revenue tax is used to fund a variety of presidency applications and companies, together with schooling, infrastructure, and nationwide protection. Self-employment taxes be sure that self-employed people pay their fair proportion of revenue tax, contributing to the general tax income collected by the federal government.

Understanding the connection between the self-employment tax kind and the cost of revenue tax, Social Safety tax, and Medicare tax is crucial for self-employed people to meet their civic duties and contribute to the well-being of society. By precisely finishing and submitting their self-employment tax varieties, self-employed people not solely adjust to tax legal guidelines but additionally help the very important applications that profit themselves and future generations.

Submitting

The annual submitting requirement for self-employment tax varieties is a vital side of the tax compliance course of for self-employed people. The April fifteenth deadline serves as a key milestone for fulfilling tax obligations and guaranteeing well timed cost of taxes owed on self-employment revenue.

Submitting the self-employment tax kind by the April fifteenth deadline is crucial for a number of causes:

- Tax Fee: Submitting the self-employment tax kind permits self-employed people to calculate and pay the taxes they owe on their self-employment revenue. This consists of revenue tax, Social Safety tax, and Medicare tax.

- Compliance: Well timed submitting of the self-employment tax kind demonstrates compliance with tax legal guidelines and rules. Failure to file by the deadline can lead to penalties and curiosity fees.

- Avoidance of Late Charges: Submitting the self-employment tax kind by April fifteenth helps people keep away from late charges and potential authorized penalties related to late submitting.

The self-employment tax kind might be filed on-line or by mail. Digital submitting is mostly most well-liked as it’s extra handy, safe, and infrequently quicker than submitting by mail. The IRS web site offers detailed directions and sources for each on-line and mail submitting.

Understanding the submitting necessities and deadlines for self-employment tax varieties is essential for self-employed people to fulfill their tax obligations and preserve compliance with tax legal guidelines. By submitting their self-employment tax varieties precisely and on time, self-employed people contribute to the honest and equitable distribution of tax burdens and help the availability of important authorities applications and companies.

Penalties

The connection between “Penalties: Failure to file can lead to penalties and curiosity fees.” and “self employment tax kind” is important as a result of it highlights the results of non-compliance with tax submitting necessities. The self-employment tax kind is a vital doc that permits self-employed people to meet their tax obligations and contribute to important authorities applications. Nevertheless, failure to file this kind by the April fifteenth deadline can result in extreme penalties and curiosity fees.

Penalties for late submitting of the self-employment tax kind are imposed by the Inner Income Service (IRS) to encourage well timed compliance with tax legal guidelines. These penalties might be substantial and accumulate over time, growing the monetary burden on self-employed people. Moreover, curiosity fees are utilized to unpaid taxes, additional growing the quantity owed to the IRS. The mixture of penalties and curiosity fees can create a big monetary hardship for self-employed people who fail to file their taxes on time.

Understanding the potential penalties of failing to file the self-employment tax kind is essential for self-employed people to prioritize their tax obligations and keep away from expensive penalties and curiosity fees. By submitting their self-employment tax varieties precisely and on time, self-employed people can preserve compliance with tax legal guidelines, shield their monetary well-being, and contribute to the honest distribution of tax burdens.

Self-Employed People

The connection between “Self-Employed People: Freelancers, contractors, and small enterprise homeowners” and “self employment tax kind” lies within the authorized obligation of those people to file and pay taxes on their self-employment revenue. In contrast to conventional workers who’ve taxes withheld from their paychecks, self-employed people are chargeable for calculating and paying their very own taxes, together with revenue tax, Social Safety tax, and Medicare tax.

The self-employment tax kind serves as a device for self-employed people to report their self-employment revenue and calculate their tax legal responsibility. This kind is crucial for guaranteeing that self-employed people fulfill their tax obligations and contribute their fair proportion to authorities applications corresponding to Social Safety and Medicare.

Understanding the connection between “Self-Employed People: Freelancers, contractors, and small enterprise homeowners” and “self employment tax kind” is essential for these people to keep up compliance with tax legal guidelines and keep away from penalties. By precisely finishing and submitting their self-employment tax varieties, self-employed people can shield their monetary well-being and contribute to the general tax income collected by the federal government.

Tax Calculation

The self-employment tax kind performs an important function in calculating taxes based mostly on internet self-employment revenue. This side highlights the importance of precisely reporting self-employment revenue and bills to find out the right tax legal responsibility.

- Tax Legal responsibility Willpower: The self-employment tax kind calculates the quantity of revenue tax, Social Safety tax, and Medicare tax owed by self-employed people. This calculation is predicated on the web self-employment revenue, which is the gross self-employment revenue minus allowable enterprise deductions.

- Revenue Reporting: Self-employed people are required to report their self-employment revenue on Schedule SE (Type 1040), which is hooked up to the self-employment tax kind. This consists of revenue from companies, freelance work, and different self-employed actions.

- Deduction Monitoring: The self-employment tax kind permits self-employed people to deduct eligible enterprise bills from their gross self-employment revenue. These deductions can considerably scale back the quantity of taxable revenue and, consequently, the tax legal responsibility.

- Tax Price Utility: As soon as the web self-employment revenue is set, the self-employment tax kind applies the suitable tax charges to calculate the quantity of taxes owed. The tax charges for self-employment taxes are usually increased than these for conventional workers, as self-employed people are chargeable for paying each the worker and employer parts of Social Safety and Medicare taxes.

Understanding the connection between “Tax Calculation: Calculates taxes based mostly on internet self-employment revenue” and “self employment tax kind” is crucial for self-employed people to precisely calculate and pay their taxes. By correctly finishing and submitting their self-employment tax varieties, self-employed people can fulfill their tax obligations, keep away from penalties, and contribute to the honest distribution of tax burdens.

Schedule SE

Schedule SE is a vital part of the self-employment tax kind, serving as a devoted part inside Type 1040 for self-employed people to report their self-employment revenue and calculate their self-employment taxes.

- Revenue Reporting: Schedule SE requires self-employed people to report their gross self-employment revenue, which incorporates revenue from companies, freelance work, and different self-employed actions. This reported revenue varieties the idea for calculating the self-employment tax legal responsibility.

- Tax Calculation: Schedule SE guides self-employed people in calculating their self-employment taxes, together with revenue tax, Social Safety tax, and Medicare tax. The shape offers step-by-step directions and calculations to find out the quantity of taxes owed.

- Self-Employment Tax Legal responsibility: Schedule SE calculates the self-employment tax legal responsibility, which represents the mixed quantity of Social Safety and Medicare taxes owed by self-employed people. This tax legal responsibility is separate from the revenue tax legal responsibility calculated on Type 1040.

- Integration with Type 1040: Schedule SE seamlessly integrates with Type 1040, permitting self-employed people to report their self-employment revenue and taxes alongside their different revenue and deductions. This integration ensures that self-employment taxes are correctly accounted for within the general tax calculation.

Understanding the connection between “Schedule SE: Used to report self-employment revenue and taxes on Type 1040.” and “self employment tax kind” is essential for self-employed people to precisely report their revenue, calculate their taxes, and fulfill their tax obligations. Schedule SE serves as a useful device throughout the self-employment tax kind, offering clear steerage and facilitating the correct calculation and reporting of self-employment taxes.

Estimated Taxes

The connection between “Estimated Taxes: Quarterly funds could also be required for estimated self-employment taxes.” and “self employment tax kind” lies within the want for self-employed people to make common estimated tax funds to keep away from potential penalties. The self-employment tax kind, usually Schedule SE, offers steerage on calculating estimated self-employment taxes.

Self-employed people are chargeable for paying estimated taxes as a result of they don’t have taxes withheld from their revenue like conventional workers. Estimated taxes cowl revenue and self-employment taxes, guaranteeing that self-employed people pay their fair proportion of taxes all year long, quite than in a single lump sum when submitting their annual tax return.

The self-employment tax kind consists of directions and worksheets to assist people calculate their estimated quarterly tax funds. These funds are usually due on April 15, June 15, September 15, and January 15 of the next 12 months. By making estimated tax funds, self-employed people can keep away from underpayment penalties and guarantee a smoother tax submitting course of.

Understanding the connection between “Estimated Taxes: Quarterly funds could also be required for estimated self-employment taxes.” and “self employment tax kind” is essential for self-employed people to meet their tax obligations responsibly. The self-employment tax kind offers important steerage on calculating and paying estimated taxes, serving to self-employed people preserve compliance and keep away from potential monetary penalties.

Incessantly Requested Questions on Self-Employment Tax Varieties

This part offers solutions to generally requested questions concerning self-employment tax varieties, providing clear and informative steerage to self-employed people.

Query 1: What’s a self-employment tax kind?

A self-employment tax kind is a doc used to calculate and pay taxes on revenue earned from self-employment. It’s usually utilized by freelancers, contractors, and small enterprise homeowners who will not be employed by a standard employer.

Query 2: Why is it necessary to file a self-employment tax kind?

Submitting a self-employment tax kind ensures that self-employed people pay their fair proportion of taxes, together with revenue tax, Social Safety tax, and Medicare tax. Failure to file can lead to penalties and curiosity fees.

Query 3: When is the deadline for submitting a self-employment tax kind?

The deadline for submitting a self-employment tax kind is April fifteenth. Nevertheless, estimated tax funds could also be required all year long to keep away from penalties.

Query 4: What info is included on a self-employment tax kind?

A self-employment tax kind usually consists of info corresponding to gross self-employment revenue, enterprise bills, and private deductions. This info is used to calculate the quantity of taxes owed.

Query 5: Can I file my self-employment tax kind on-line?

Sure, self-employment tax varieties might be filed on-line via the IRS web site or via tax preparation software program.

Query 6: What occurs if I fail to file a self-employment tax kind?

Failure to file a self-employment tax kind can lead to penalties and curiosity fees. It is very important file your taxes on time to keep away from these penalties.

Understanding these FAQs might help self-employed people navigate the complexities of tax submitting and fulfill their tax obligations precisely and effectively.

Transition to the subsequent article part: Understanding the nuances of self-employment tax varieties is essential for guaranteeing compliance and avoiding potential monetary penalties. This text delves deeper into the intricacies of self-employment tax varieties, offering a complete information to their completion and submitting.

Self-Employment Tax Type Ideas

Self-employment tax varieties might be advanced, however understanding and finishing them precisely is crucial for self-employed people. Listed below are a number of tricks to help in navigating self-employment tax varieties successfully:

Tip 1: Collect Vital Paperwork

Earlier than beginning the self-employment tax kind, collect all related paperwork, corresponding to revenue statements, expense receipts, and mileage logs. Group will streamline the submitting course of and guarantee accuracy.

Tip 2: Calculate Web Revenue Precisely

The online self-employment revenue varieties the idea for tax calculations. Deduct eligible enterprise bills from gross revenue meticulously to find out the right taxable revenue.

Tip 3: Perceive Tax Charges

Self-employment taxes embody revenue tax, Social Safety tax, and Medicare tax. Familiarize your self with the relevant tax charges to make sure correct calculation of tax legal responsibility.

Tip 4: Think about Estimated Taxes

Self-employed people are chargeable for making estimated tax funds all year long. Decide if estimated tax funds are crucial based mostly on revenue projections to keep away from penalties for underpayment.

Tip 5: Use Tax Software program or Search Skilled Assist

Tax software program can simplify the tax submitting course of by guiding you thru calculations and guaranteeing accuracy. If wanted, contemplate looking for help from a tax skilled to navigate advanced tax conditions.

By following the following pointers, self-employed people can strategy self-employment tax varieties with confidence, decrease errors, and fulfill their tax obligations precisely and effectively. Understanding and finishing self-employment tax varieties is essential for sustaining compliance, avoiding penalties, and contributing to important authorities applications.

Conclusion

Self-employment tax varieties function an important device for self-employed people to meet their tax obligations and contribute to important authorities applications. Understanding the importance of those varieties and finishing them precisely is paramount for sustaining compliance, avoiding penalties, and guaranteeing monetary safety.

This text has explored the assorted features of self-employment tax varieties, offering clear explanations and sensible tricks to help self-employed people in navigating the tax submitting course of successfully. By leveraging the knowledge and steerage supplied herein, self-employed people can strategy their tax duties with confidence and contribute to the honest distribution of tax burdens.

Youtube Video: